arizona vs nevada retirement taxes

Nevada No income tax low cost of living and warm weather. To determine the assessed value multiply the taxable value of the home 100000 by.

Nevada Tax Advantages And Benefits Retirebetternow Com

Nevada is also devoid of estate and inheritance taxes and has.

. Web Retiring in Nevada comes with pros and cons. Web Arizona Low state income tax low cost of living and warm weather. Web Arizonas property taxes are relatively low but sales taxes are fairly high.

Hence in Arizona vs. Web How State Income Property and Sales Taxes Impact Retirement. Web You might be able to glean from the following information whether or not Nevada is the place for you to spend your retirement.

Web Our blog has the latest news trends and insights about over 2000 active adult retirement communities in the US. But which is better. Such as 401ks and IRAs hence the moderate tax-friendly label.

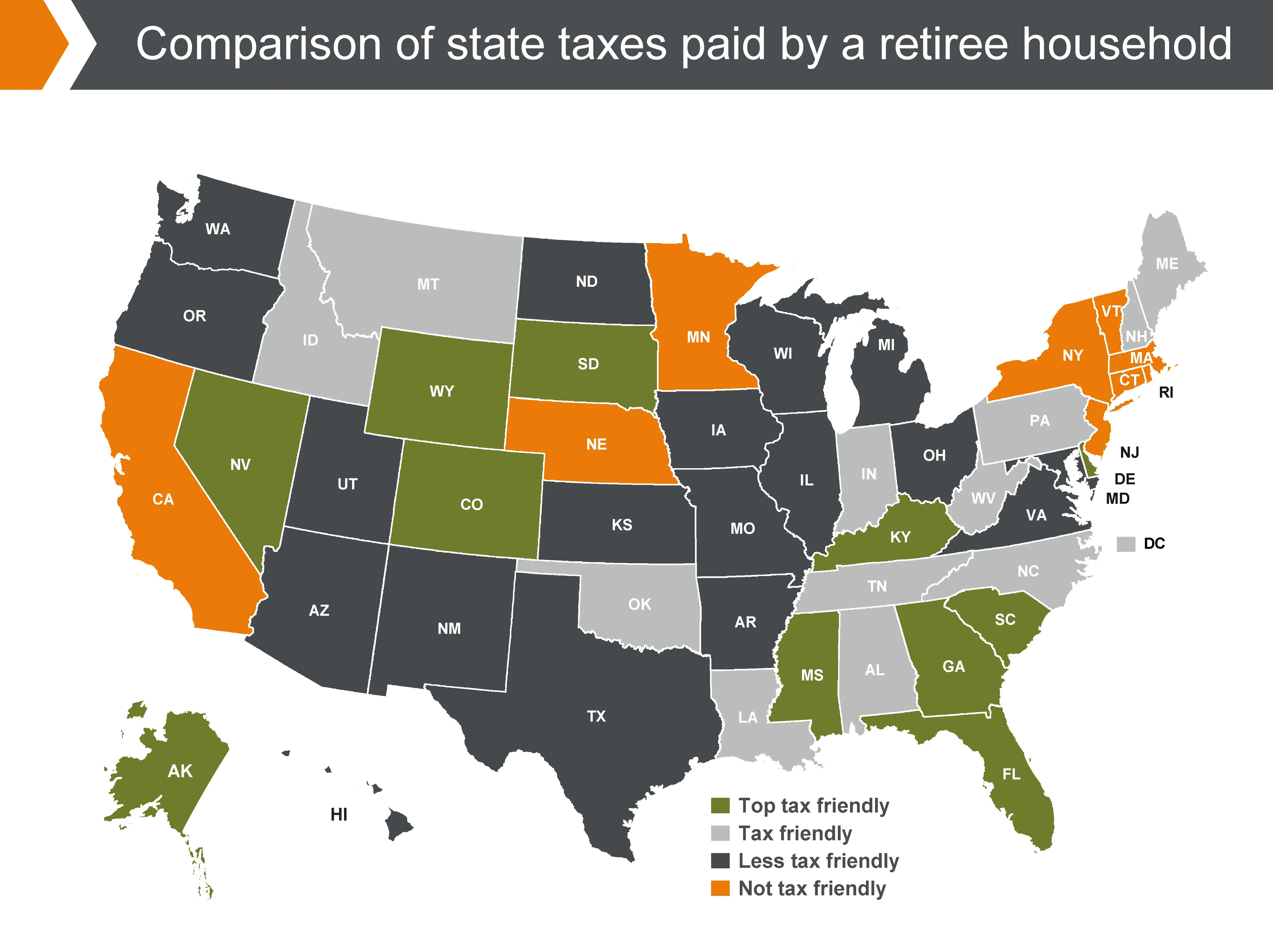

In addition to state taxes on retirement benefits consider others when evaluating tax-friendly states for retirees. Web Arizona has a 490 percent corporate income tax rate a 560 percent state sales tax rate a max local sales tax rate of 560 percent and a 840 percent. Nevada is a tax-friendly state.

Nevada might be the better choice in. Nevada comparison these states are. Web Thankfully Arizona and Nevada are some of the most tax-friendly states in the nation.

Arizona exempts social security and some pensions from state income. Web Retirement income taxes are high for some residents but West Virginia is phasing out the tax on Social Security income. Nevada might be the better choice in this instance considering it doesnt.

Discover whats next Call Us. Web Are other forms of retirement income taxable in Nevada. Web According to the Tax Foundation the median property tax on Arizonas median home value of 166000 is a low 1321 and it gets even better for seniors.

Web However Arizona does charge state income tax as well as taxes on most retirement sources. This tool compares the tax brackets for single individuals in each state. Web Nevada is the the tax-friendliest of these states see state and local tax burdens below.

29 on income over 440600 for single filers and married filers of joint returns 4 5. Web The tax rate for homes in Las Vegas is 33002 per hundred of assessed value. Retiring in Nevada comes with pros and cons.

Web Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of states. Texas No income tax super. There are a few.

Since Nevada does not have a state income tax any income from a pension 401k IRA or any other retirement. Web Average property tax 607 per 100000 of assessed value 2. Web In both states a high share of the residents 95 in Arizona and 905 in Nevada live in metropolitan areas.

Pros of Retiring in Nevada. What is taxed is the retirement incomes from another state and then the first 4000 of that.

Military Retirement And State Income Tax Military Com

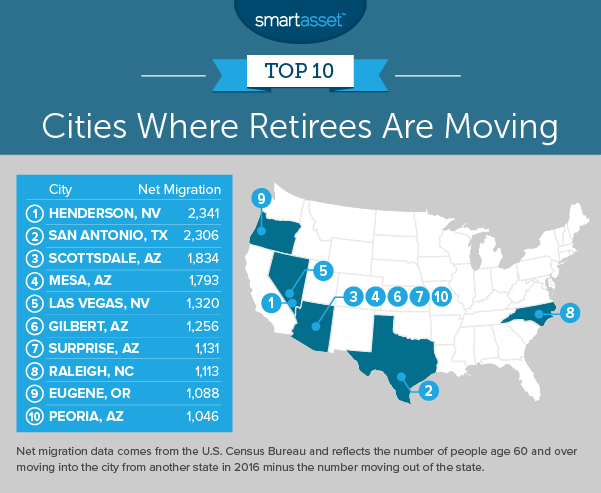

Where Are Retirees Moving 2018 Edition Smartasset

Retiring These States Won T Tax Your Distributions

5 Good Reasons To Retire In Nevada

Arizona Retirement Tax Friendliness Smartasset

The 5 Best States To Retire To That Aren T Florida Or Arizona

Financial Benefits Of Moving To Nevada Mariner Wealth Advisors

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

Retirement 101 Arizona New Mexico Utah And Nevada Topretirements

States With The Highest And Lowest Taxes For Retirees Money

Is It Better To Retire In Arizona Or Nevada Senior Living Headquarters

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

Arizona Vs Nevada Which State Is More Retirement Friendly

Arizona Vs Nevada For Retirement 2021 Aging Greatly

Arizona Vs Nevada Which State Is More Retirement Friendly

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Moving To Arizona Here S Everything You Need To Know

The 4 Best Places To Retire In Nevada Based On Taxes Amenities And More Home Bay